L.A. Median Home Price Tops Half A Million!

Link To This Post.

Find More At Google Blogsearch.

The LA Times says wha-wha-what? They use an increase in the median home price to argue that the bubble isn't popping? What about inventory? What about inventory? What about inventory?

The LA Times says wha-wha-what? They use an increase in the median home price to argue that the bubble isn't popping? What about inventory? What about inventory? What about inventory?Sorry, my circuits were fried there for a second. But my point is ... What about inventory? Prices may continue to rise, but if inventory starts to stack up at the same time, then the median price means nothing. If only two houses sold and one was $1 million and the other $2 million, the median price would be $1.5 million, but so what? The real story would be that only two houses sold. You couldn't use the median to argue that the bubble hasn't popped.

Aiiiiii. What about inventory?

What the Times story doesn't tell you until the final few paragraphs is that, as DataQuick News found, volume is off. The number of homes sold in February was down dramatically from 2005 figures.

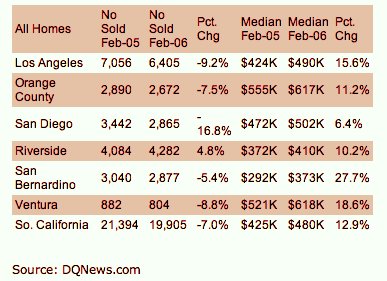

What the Times story doesn't tell you until the final few paragraphs is that, as DataQuick News found, volume is off. The number of homes sold in February was down dramatically from 2005 figures.Sales were down by 9.2 % for Los Angeles, says DataQuick News, which generated the chart at right. Homes sold dropped by 7.5% in Orange County and a whopping 16.8% in San Diego. Even Ventura County was down — 8.8%. Home sales for the whole of Southern California were down 7.0%.

So, even though prices are up, the number of homes sold is down. That absolutely does speak to a bubble pop.

Here's an excerpt from the Times:

If there is a real estate bubble, it sure doesn't want to pop just yet. For the first time, the median home price in Los Angeles County crossed $500,000, a real estate research firm said today.Remember Issac Newton's First Law of Motion, which states:

The county's median sales price in March for all homes, including condominiums, hit $506,000, up 15% from the same month last year, according to data released today by DataQuick Information Systems.

Four years ago, the median was half that.

Sales in March, however, sagged 10.3% to 9,755 properties.

Existing homes saw the biggest year-over-year appreciation in March, with the median sales prices jumping 17.4% to $540,000, according to DataQuick. Existing condos also posted a large increase of 15.3% to $415,000. But the median price for new homes fell 1.7% to $455,000.

Figures for the rest of Southern California were not yet available.

With Los Angeles' median home price doubling in such a short period — giving homeowners more equity than they imagined a few years ago — it's no wonder that Los Angeles appears on many lists of the nation's most overvalued housing markets. That suggests it could be vulnerable for a repeat of the early 1990s, when the county was one of the few markets in the nation where prices declined.

But a lot has changed since then. The region's economy is much more diverse and less dependent on any single industry, such as aerospace, where a sharp loss of jobs due to defense cutbacks sparked the early 1990s collapse, according to industry observers.

Every body perseveres in its state of being at rest or of moving uniformly straight ahead, except insofar as it is compelled to change its state by forces impressed.In other words, if you throw a ball up in the air, its velocity will decrease as it gains altitude. Gravity becomes a complicating factor on inertia. When the ball has reached its highest point, velocity is zero, and then the object returns to Earth.

That's reality.

The same principle applies to this housing market as it slows for the inevitable plunge back to Earth, and reality.

-- The Boy in the Big Housing Bubble/Los Angeles and Beyond

<< Home