California Buyers Are Increasingly unARMed

Link To This Post.

This should surprise no one.

This should surprise no one. DQNews.com is reporting a drastic decline in California's use of ARMs, also known as "adjustable rate mortages."

In case you don't know how an ARM works, it's like this... the basic ARM has a fixed interest rate for the first six months, and so, your payments are the same for each of those six months. But, after that, your rate and monthly payment readjusts every six months for the life of the loan. There are a variety of ARMs that shuffle the details. Some lock in a rate for several years, and then become six-month adjustables when the initial term expires.

The risk of these loans is explained well at Wikipedia, which says:

If a borrower is inconsistent in their on time payment history, afflicted by tragedy which causes a credit problem, or keeps insufficient funds in reserve (the payment savings from the lower rate for example), as referenced above, the rates in Hybrid ARMs will certainly rise, and with insufficient credit and income, the borrower may be forced to trade equity for time, and in some markets, not as advantageously as today.And so, you see, with mortgage rates inching up and Congress getting increasingly concerned about the possibility that future foreclosures could put their re-election campaigns in the dumper, there are no surprises in the data from DQNews.com. Here's an excerpt from their story:

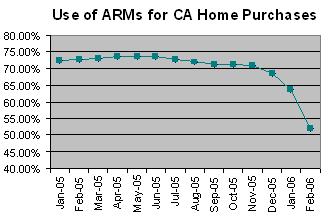

The use of adjustable-rate mortgages for home purchases has declined significantly in California during the past three months, the result of more caution among buyers and lenders in a market that is seeing slowing increases in home values, a real estate information service reported.

In February 51.9 percent of all home buyers financed their purchases with an ARM, down from 63.7 percent in January, 68.7 percent in December and 70.9 percent in November, according to DataQuick Information Systems.

The use of ARMs, which are easier to get and are considered by many to be an indication that buyers are stretching their finances, peaked in May last year at 73.7 percent. Peak usage during the prior real estate cycle was in September 1988 when ARMs accounted for 66.1 percent of all home purchase loans.

"Some of the financing issues at play here are fairly complex and would include this year's higher conforming loan limit, the spread between the cost of an ARM and a fixed-rate mortgage, use of equity lines, and federal regulators who have recently told lenders to lower risk levels," said Marshall Prentice, DataQuick president.

— The Boy in the Big Housing Bubble

<< Home