Riverside Foreclosures Up 43 Percent!

Link To This Post

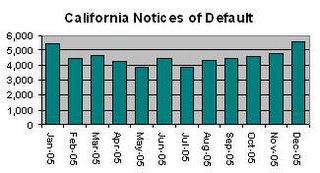

Foreclosures are one of the first tragedies of the popping of our housing bubble in Southern California, and it's already started. As reported by DataQuick News California foreclosures are up throughout the Southland, and the entire state (See chart a right from DataQuick's site).

Foreclosures are one of the first tragedies of the popping of our housing bubble in Southern California, and it's already started. As reported by DataQuick News California foreclosures are up throughout the Southland, and the entire state (See chart a right from DataQuick's site). Riverside County, which has seen some of the most significant growth in housing construction statewide, is now seeing some of the most financial trouble in the Southland, as indicated by a 43 percent jump in notices of default for both houses and condominiums. The percentage compares totals for the fourth quarter of 2005 to the fourth quarter of 2004. Los Angeles County was up nearly 11 percent for that period, but Ventura County, to the north, was up just 2.8 percent, less than any of the other SoCal counties.

Ventura County has always shunned its membership as part of Southern California. As the northernmost member of its ranks, VC has always viewed Los Angeles as something it wanted to disassociate itself with, rather than join. Planners in VC describe LA almost as though it were a cancer that spread across hills and valleys. Ventura County, on the other hand, has supposedly sought to keep farms operating as farms. When it's voters embraced growth restrictions a few years ago one had to wonder if they were doing so out of a love for farms and open space, or to turn the whole place into one big gated community. That one might very well backfire on them because the one thing they can't regulate is demand, and once they reach buildout, prices will get so high that none of their service workers will be able to afford the place. Already they have a number of law enforcenemnt officers who commute there from Los Angeles County.

It will be interesting to see what happens to those Ventura County foreclosure numbers in the next few months. Watch for them to shoot up if interest rates continue to rise.

Here's the report from DataQuick News with a chart by county on the same page:

Foreclosure activity in California edged up in fourth-quarter 2005, the result of lower appreciation rates, a real estate information service reported.

Lending institutions sent 14,999 default notices to California homeowners during the October-to-December period. That was up 19.0 percent from 12,606 for the third quarter, and up 15.6 percent from 12,978 for 2004's fourth quarter, according to DataQuick Information Systems.

Foreclosure activity hit a low during the third quarter of 2004 when 12,145 default notices were recorded. Defaults peaked in 1996's first quarter at 59,897. DataQuick's default statistics go back to 1992.

"There's always going to be a certain amount of financial distress. People lose their jobs, have medical emergencies, get divorced, pass away or make bad money decisions at a certain rate. Because of the rise in home values, much of that financial distress has been covered by the increasing amount of equity that people have had in their homes. That equity is now being created at a slower pace, and default activity is inevitably on the rise," said Marshall Prentice, DataQuick president.

The annual home appreciation rate in the state hit 22.8 percent during the second quarter of 2004. Since then it has come down and in fourth-quarter 2005 it was 14.5 percent. The appreciation rate is expected to fall below 10 percent sometime this summer.

DataQuick, a subsidiary of Vancouver-based MacDonald Dettwiler and Associates, monitors real estate activity nationwide and provides information to consumers, educational institutions, public agencies, lending institutions, title companies and industry analysts. The numbers count recorded notices of default, the first step of the formal foreclosure process.

The median amount owed when the default notice was recorded was $6,862 in fourth-quarter 2005, up from $6,130 for the same period a year ago.

Only about five percent of homeowners who find themselves in default actually lose their homes to foreclosure. Most are able to stop the foreclosure process by bringing their mortgage payments current, or by selling their home and paying the home loan(s) off.

All regions of the state saw an increase in foreclosure activity, ranging from 10.5 percent in the Bay Area to 19.6 percent in Southern California (see chart).

On a loan-by-loan basis, mortgages are least likely to go into default in Marin County. The likelihood is highest in the Central Valley and Inland Empire.

While foreclosure properties tugged property values down by almost ten percent in some areas nine years ago, the effect on today's market is negligible, DataQuick reported.

— The Boy in the Big Housing Bubble

<< Home