NAHB Fighting Tax Reform

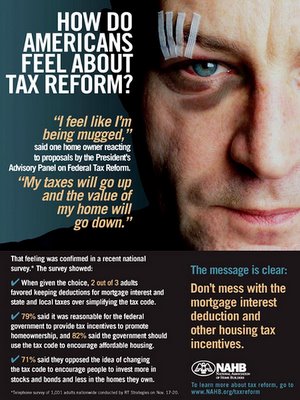

The National Association of Home Builders placed the ad above in the National Journal, Congressional Quarterly Weekly, Roll Call and the Washington Post this week. It refers to survey results touted in an NAHB Press Release also published this week.

The National Association of Home Builders placed the ad above in the National Journal, Congressional Quarterly Weekly, Roll Call and the Washington Post this week. It refers to survey results touted in an NAHB Press Release also published this week.NAHB, and a lot of homeowners, are worried about talk in Congress of reforming the holiest of holy tax breaks, the mortgage interest deduction. This survey, which was financed by NAHB, apparently pitted the status quo against simplifying the tax code:

Two out of three survey participants (68 percent) favor retaining deductions for mortgage interest and state and local taxes over a plan to simplify the current tax code, according to the polling conducted by RT Strategies on Nov. 17-20.

“The survey offers a cautionary note for those in the Administration and on Capitol Hill who

may be tempted to endorse the recommendations of the President’s Advisory Panel on Federal Tax Reform, which would wipe out popular tax incentives that promote homeownership and affordable housing,” said Jerry Howard, executive vice president and CEO of the National Association of Home Builders (NAHB).

The White House and Treasury Department have yet to comment on the advisory panel’s proposal, which was presented to the Administration on Nov. 1 as part of an overall attempt to overhaul the tax code.

The plan calls for replacing the mortgage interest deduction with a far more limited 15 percent tax credit. Also gone would be deductions for state and local taxes (including property taxes) and interest deductions for home equity loans and second homes. It would also eliminate the Low Income Housing Tax Credit, which accounts for the construction of more than 130,000 affordable rental housing units annually.

Commissioned by NAHB to determine the public reaction to revamping the current tax system, the polling firm found that an overwhelming majority of respondents support federal tax policies that foster the American dream of owning a home.

Specifically, 79 percent said it is reasonable for the federal government to provide tax incentives to promote homeownership, and 82 percent believe the government should use the tax code to encourage affordable housing.

— The Boy in the Big Housing Bubble

<< Home