Putting The ‘Market’ in ‘Housing’

Stock traders will be able to trade in more than just home-builder stocks next year. Begining in April 2006, they'll be able to gamble on the price of your house.

Stock traders will be able to trade in more than just home-builder stocks next year. Begining in April 2006, they'll be able to gamble on the price of your house.A story by Associated Press Business Writer Dave Carpenter says the Chicago Merc has inked a deal to allow the trading of housing-price futures, which are explained in this excerpt:

Investors will be able to trade contracts electronically based on median home prices in Boston, Chicago, Denver, Las Vegas, Los Angeles, Miami, New York, San Diego, San Francisco or Washington D.C. — or a composite index of the ten cities. The indexes were developed by the real estate research firm Fiserv Case Shiller Weiss Inc.This is an excerpt from the middle of the story. The entire text can be found at this link.

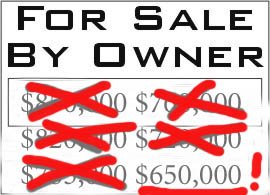

Those who are optimistic that prices will continue their double-digit rise can simply buy contracts, making a profit if the increase exceeds their costs by the expiration date.

Investors who want to soften the potential blow of a steep decline, on the other hand, can buy versions of the contracts called put options that will pay them money if the price drops, ensuring that they recoup some of their lost house profits.

That strategy is akin to taking a short position in a stock, according to Felix Carabello, Merc associate director for alternative investments. But ``instead of shorting IBM, you're shorting your house,'' he said.

For example, a Los Angeles homeowner looking to hedge the value of his $1 million house could buy ``puts'' linked to that city's housing index, at a cost of several thousand dollars. If Los Angeles housing prices are higher by the time the quarterly contract expires, the puts have no value and the investor is out the costs. If prices go down, the puts enable the investor to sell the contracts for a gain.

While there has never been a nationwide decline in housing prices, there are precedents for sharp declines in regional housing values. Los Angeles home prices fell 41 percent in real terms from 1989-97, and Boston's dropped 29 percent from 1987-94.

— The Boy in the Big Housing Bubble

<< Home