NAR Posting Anti-Bubble Reports

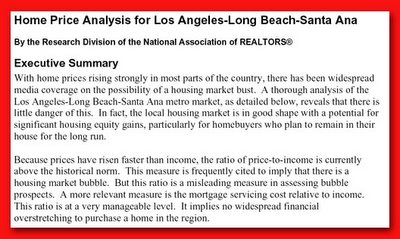

The National Association of Realtors is posting reports on an Internet web page bearing both the URL and title "Anti-Bubble Reports." The page features a collection of 130 downloadable reports, each for specific metropolitan areas. Pictured above is a blurb from the report for Los Angeles, CA.

The National Association of Realtors is posting reports on an Internet web page bearing both the URL and title "Anti-Bubble Reports." The page features a collection of 130 downloadable reports, each for specific metropolitan areas. Pictured above is a blurb from the report for Los Angeles, CA.On the Anti-Bubble Reports page, NAR touts the consumer info this way:

These downloadable 10-page reports show that the facts simply do not support the possibility of a housing bust -- not for these 130 markets and not for the nation.The report for Los Angeles, however, appears to completely ignore the Housing Affordability Index data that NAR's state organization has been putting out all year. Indeed, the NAR seems interested only in focusing on the question of a "national" housing bubble, a possibility that few analysts have embraced. NAR's only mention of local, or regional bubbles appears to be in that blurb above, where it says the facts don't support the possibility of a bust in "these 130 markets," nor the nation. The lack of in-depth discussion about the possible existence of local or regional bubbles, which have been emphasized for months by analysts, is a curious omission.

Consider this from the NAR Anti-Bubble report on Los Angeles:

"Because prices have risen faster than income, the ratio of price-to-income is currently above historical norm. This measure is frequently cited to imply that there is a housing market bubble. But this ratio is a misleading measure in assessing bubble prospects. A more relevant measure is the mortgage servicing cost relative to income. This ratio is at a very manageable level. It implies no widespread financial overstretching to purchase a home in the region.Now, look at what the California Association of Realtors said in its most recent report:

The minimum household income needed to purchase a median-priced home at $543,980 in California in September was $128,270, based on an average effective mortgage interest rate of 5.90 percent and assuming a 20 percent downpayment.An income of $128,270 just to purchase the median! That's the state median, not the local market median, which in Los Angeles is now $557,730, according to CAR's October numbers.

The author Mark Twain is often quoted in reference to a comment he once made about "lies, damn lies and statistics." The point Twain so wonderfully expressed is that you can make statistics say whatever you want. You just emphasize the ones that prove your point, and ignore the ones that don't. This is something journalists jokingly refer to as "not letting the facts get in the way of a good story." I hope consumers ask themselves why these kinds of reports never look at things like per-capita income levels. Why do they never mention the median income, which in Los Angeles was $53,100/year in 2004? That's less than half the income necessary to purchase a single-family home priced at the median level.

NAR's Anti-Bubble site also links to a Housing Bubble Q&A, which the URL terms "Anti-BubbleQ&A."

The Housing Bubble Q&A is long, so you'll have to go to the link to see the whole thing, but here's one of the most interesting responses:

What is likely to happen with home prices?Hold that thought until this time next year. We'll see if they're right.

The forecast is for mortgage interest rates to rise slowly over the next year, which will have a minor breaking effect on home sales. The good news is that will help inventory levels to recover and allow the market to come into a closer balance between buyers and sellers.

In other words, a general slowing in the rate of price growth can be expected, but in many areas inventory shortages will persist and home prices are likely to continue to rise above historic norms.

- The Boy in the Big Housing Bubble

<< Home