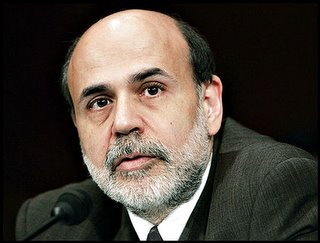

Bernanke's Thought Bubble

Ben Bernanke, Greenspan's likely replacement as chairman of The Federal Reserve, supposedly doesn't believe there's a housing bubble, as reported by the Washington Post last week.

You'd be foolish to expect Bernanke, or anyone else in his position, to say anything else. Who would stand a chance of being confirmed by the U.S. Senate (going into an election year) after expressing belief in a catastrophic housing bubble? I'm going to guess that selling yourself after that admission would be like selling hot dogs at a PETA rally.

And so, it was with some skepticism that I read Bernanke's quotes as reported in a story by Neil Henderson in the Washington Post:

"House prices are unlikely to continue rising at current rates," said Bernanke, who served on the Fed board from 2002 until June. However, he added, "a moderate cooling in the housing market, should one occur, would not be inconsistent with the economy continuing to grow at or near its potential next year."

Greenspan has said recently that he sees no national bubble in home prices, but rather "froth" in some local markets. Prices may fall in some areas, he indicated. And he warned in a speech last month that some borrowers and lenders may suffer "significant losses" if cooling house prices make it difficult to repay new types of riskier home loans -- such as interest-only adjustable-rate mortgages.

Bernanke did not address the possibility of local housing bubbles or the risks faced by individual borrowers or lenders in a slowing market.

However, Bernanke did express concerns about widespread borrowing and lax saving in a speech he gave in April of this year:

The expansion of U.S. housing wealth, much of it easily accessible to households through cash-out refinancing and home equity lines of credit, has kept the U.S. national saving rate low--and indeed, together with the significant worsening of the federal budget outlook, helped to drive it lower.

Keep all of this in mind now as you read Bernanke's comments regarding openness and the The Federal Reserve. This more open approach is in direct contrast to the methods embraced during the popular leadership of Alan Greenspan.

From Associated Press reporter Jeannine Aversa via BusinessWeek:

Ben Bernanke may bring more openness to the secretive Federal Reserve by spelling out what the central bank thinks is an acceptable range of inflation. And that could help consumers and investors better understand where interest-rate policy is heading.Sounds to me like something you'd say if you expected the good times to end, and the criticisms to fly. Explaining your motivations only works to your benefit during the bad times, when everyone's questioning what you're doing and why. Wonder if he privately questions when that non-existant bubble is going to pop?

- The Boy in the Big Housing Bubble

<< Home