Affording the Unaffordable

*

*A study released today by the Public Policy Institute of California has found that many Californians have big salaries that allow them to buy housing. It also found a lot of people who are "house poor."

FROM THE PPIC REPORT:

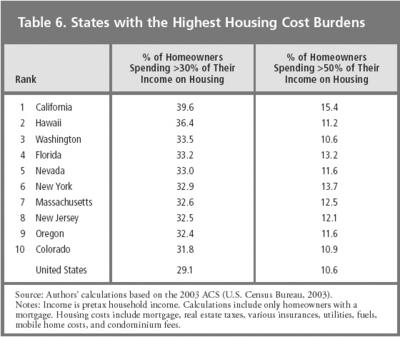

Californians can also buy a home by becoming “house poor” — paying an inordinate share of their income on housing. The U.S. Department of Housing and Urban Development (HUD) guidelines recommend that a household pay no more than 30 percent of its income on housing costs (U.S. Department of Housing and Urban Development, 2005). In California, 40 percent of all households with mortgages exceed this recommended threshold, a higher share than in any other state. The state’s newest homebuyers are even more likely to exceed this threshold. About half of recent homebuyers (52%) pay more than 30 percent of their income on housing costs. Perhaps even more remarkable, 20 percent of recent homebuyers in California spend more than half of their income on housing costs. When we examine affordability by income, we see that lower- and moderate-income households ($60,000 and below) who recently purchased a home devote a large share of their income to housing. Three-quarters or low and moderate-income recent buyers spend more than 30 percent of their income on housing and one-third spend more than 50 percent. Recent home buyers at all income levels, in the rest of the nation spend far lower.A free download of the 20 page report is available by clicking This link.

These data suggest that large numbers of homeowners in California have relatively low levels of disposable income after paying for their housing. However, the effect on disposable income is undoubtedly tempered by income tax benefits and the wealth effect. Those who have purchased their homes in California even a couple years ago have experienced strong appreciation in value and therefore large gains in home equity. These gains in wealth are, of course, less liquid than income, but some Californians have converted their equity to cash by taking out home equity loans, refinancing their mortgages, or adding additional mortgages. We found that 10 percent of recent homebuyers and 15 percent of all other homeowners in the state have a home equity loan. Such practices may or may not be financially sound, but they could alleviate the house-poor effect that many homeowners in California would otherwise experience.

* Table 6 is taken from the PPIC report.

<< Home